Customers can manage their 21st Century auto insurance at any time of the day from anywhere through the company’s website. Payments can be made online with credit or debit cards (MasterCard, Visa and Discover), ACH payments and by phone at 1-877-310-5687.

21st Century login

How to Login

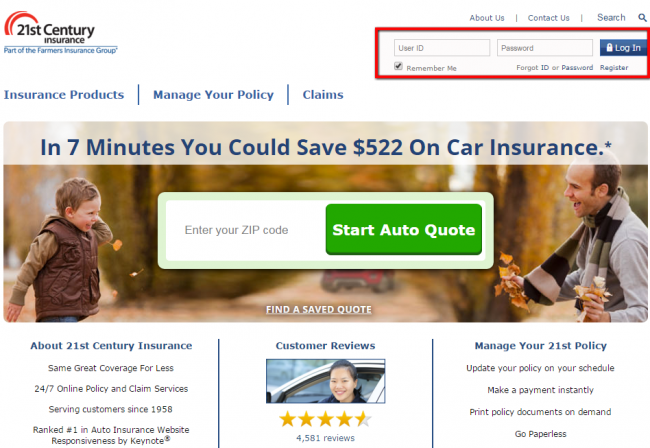

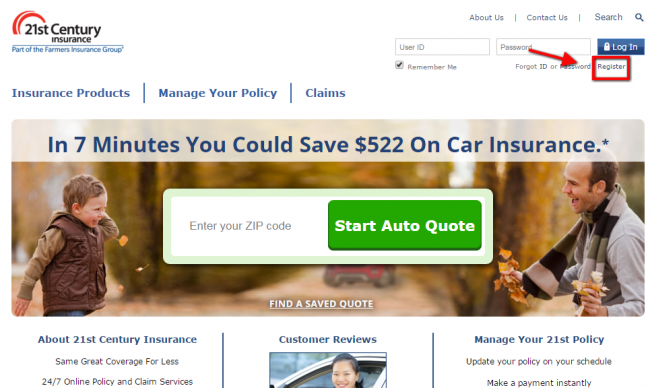

Step 1 – Go to the company’s homepage and locate the login form at the top right hand side as shown below.

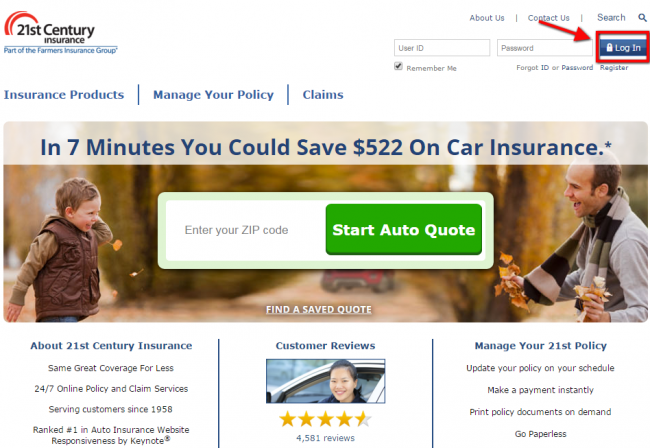

Step 2 – Enter your user ID and password then click ‘Login’.

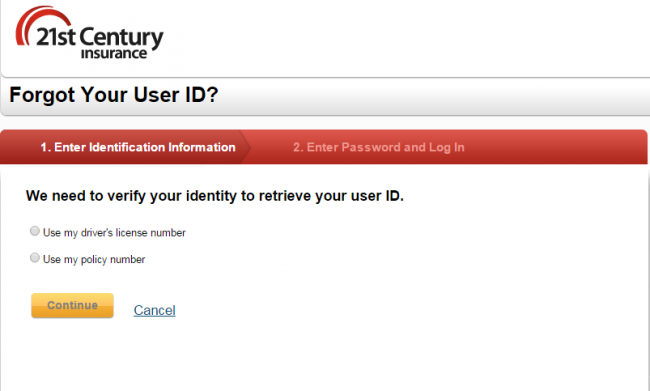

- Forgot ID – Choose whether you want to verify your ID with your policy number or license number. Click next to enter your password.

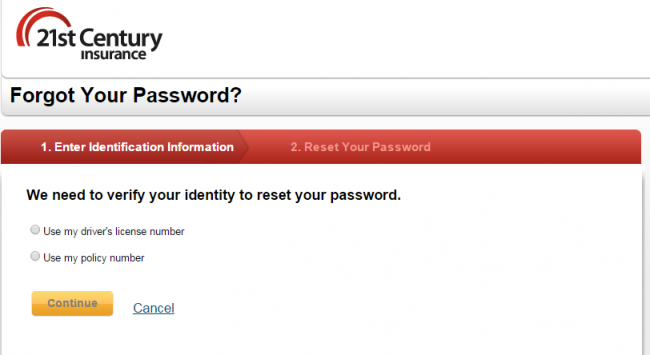

- Forgot Password – If you have forgotten your password, click on the ‘forgot password’ link below the login form. Choose whether you want to verify your ID using your license number or policy number. Click next to reset your password.

Enroll in Online Access

Step 1 – Go to the homepage and click ‘Register’ below the login form.

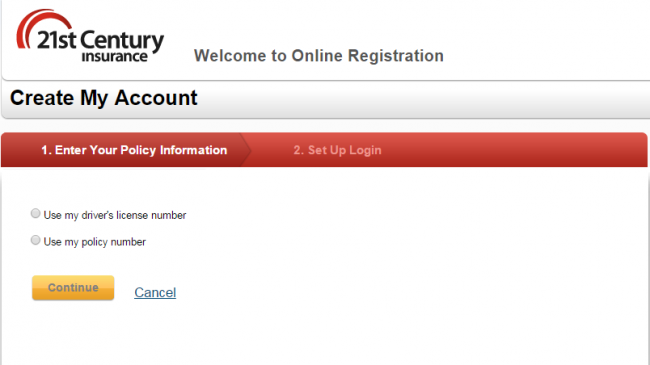

Step 2 – You will be redirected to the online registration page. Here, you are required to enter your policy information. Choose whether you want to use your driver’s license number or policy number to register. For each, you will be required to enter your date of birth and zip code. Click ‘continue’ to proceed.

Step 3 – Set up your login information to complete registration.

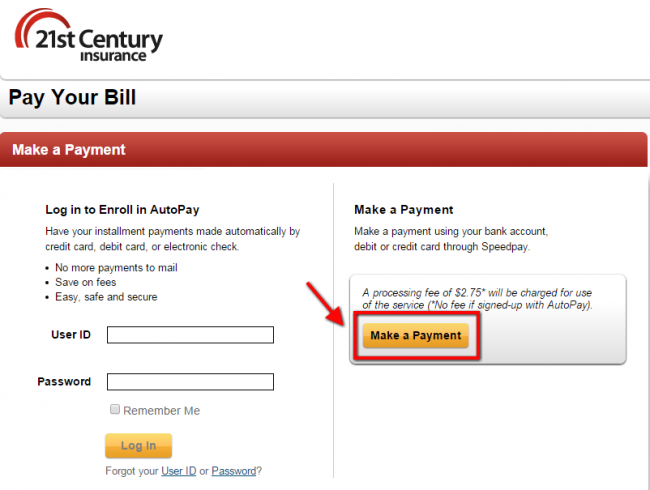

Non-Login Payment

Customers can pay for their policies without logging in by following the steps below:

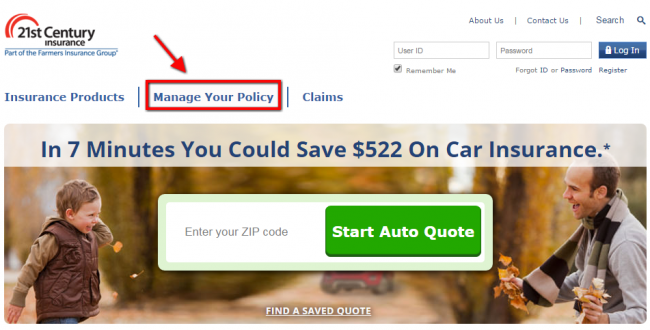

Step 1 – On the homepage, point your cursor at ‘Manage Your Policy’ on the top menu as shown below.

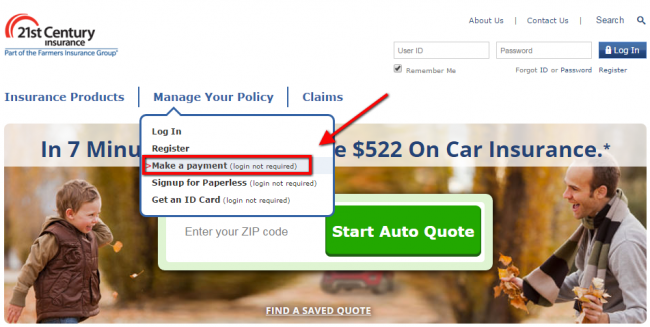

Step 2 – On the drop down menu that appears, click on ‘Make a Payment’

Step 3 – Click on ‘Make a Payment’ on the right hand of your screen as shown below.

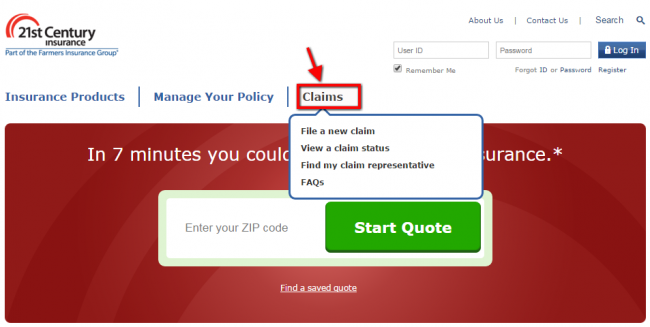

Make a Claim

Step 1 – Go to the company’s homepage and point the cursor over claims on the main menu as shown below. A drop down menu will appear as shown below.

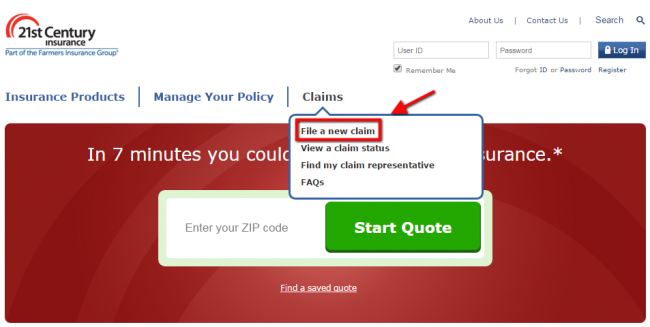

Step 2 – Click on ‘File a new claim’ on the drop down menu as shown below.

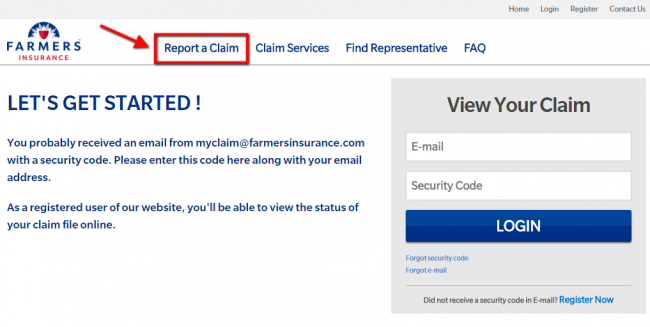

Step 3 – You will be redirected to a new page where you will be required to click on ‘Report a Claim’.

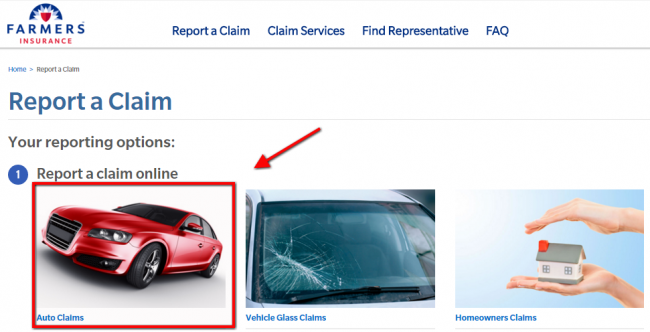

Step 4 – On the next page, click on Auto Claims.

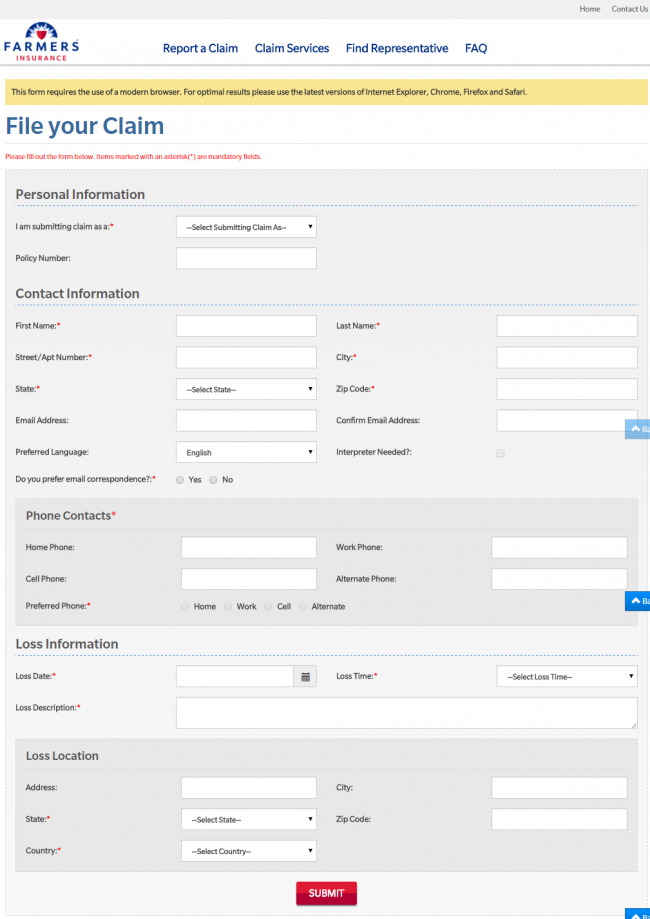

Step 5 – Fill in the claims form. You will be required to enter your personal details, contact information and loss information. Click ‘Submit’ when you are done.

NOTE: If you do not want to use the online claims process, you can call the insurer at 1-888-244-6163.

21st Century Auto Insurance Review

21st century is an insurance carrier that offers solid coverage options at an affordable price to drivers in California. The company has been offering insurance to people in California since 1958 and they are a part of Farmers Insurance Companies, which is one of the biggest insurance carriers in the United States. 21st Century car insurance helps you find the coverage you need at a price that you can afford. They offer 24/7 customer service and most of what you need to do in terms of quotes and claims can be done online.

On the 21st Century webpage, there is the 21st Century login where you can easily manage your policy/policies and make payments to your premium as well. There are quite a few driver discounts available and they are a good choice for high-risk drivers. They are committed to your satisfaction and you know they are financially stable being a part of the Farmers Insurance Group. On top of that, Farmers received a financial strength rating of A from the reputable AM Best.

Types of Coverage 21st Century Auto Insurance Offers

Here are the basic types of coverage available from 21st Century insurance:

- Collision – This type of coverage can help cover costs for damage to your vehicle if there is an accident with another vehicle.

- Uninsured Motorist – This can pay for medical expenses and other expenses if you are in an accident and are injured and it was caused by a driver that is either uninsured or underinsured.

- Liability – This coverage is for both liability for bodily injuries and property damage.

Other insurance coverage options from 21st Century are insurance are:

- Rental Reimbursement – This optional coverage begins at $30 per day and can go up to $900. There is also another option for this type of coverage for rentals for $50 daily up to $1500 with a slightly higher premium.

- Roadside Assistance – This is offered to you free of charge and the price of the coverage is $75 and you can choose to increase the coverage if you wish.

- Auto Glass Repair – For a claim where there is glass to your vehicle involved you are able to make a claim through an appointment online as well as over the phone.

- Bodily Injury Liability – You can choose different levels of coverage for the California state minimum, all the up to $1 million.

- Property Damage Liability – You can choose this coverage for the California state minimum and go up to $200,000.

21st Century Auto Insurance Prices

21st Century auto insurance is one of the more affordable options for California drivers. One the 21st Century website it states, “in 7 minutes you could save $317 on car insurance.” If you look online and check out 21st Century insurance company reviews, you will see quite a few that show you how much you can save as opposed to using other carriers.

The price you pay for premiums will depend on what coverage you would like as well as other things such as:

- Your age

- Your gender

- Marital status

- The area where you live in California

- If you live in a gated community

- Your driving record

- Make and model of your vehicle

To get more pricing information you can call the general inquiry 21st century insurance phone number at 1-877-401-8181 and to get a free quote you can also call 1-877-310-5687.

21st Century Auto Insurance Discounts

One of the nice things about 21st Century car insurance is they have several discounts where you can really save some money on your auto insurance. The discounts available are:

- Good Driver Discount – You can save 20% or more on your car insurance if in the last three years you have not been in any accidents and you have not had any traffic tickets. In order to qualify for this discount you have to have had your driver’s license for three consecutive years.

- Superior Driver Discount – You can save 10%-20% if you have a good driving record for four years and you can save more if your driving record is a good one for more than five years.

- Good Student Discount – You can save on average 15% if you are a student and you keep good grades. This is available to students that are under the age of 25 and maintain at least a B average.

- Mature Driver Discount – You can save on average 2% if you are 55 years or older. To be eligible for the discount you have to take part in a defensive driving course that is recognized by the state of California.

- Multi-Car Discount – You can save money if you have more than one car, or more than one driver, in the same 21st Century auto insurance policy.

- Anti-Theft Discount – You can save money if there is an anti-theft device equipped on your vehicle.

- Driver’s Education Discount – By taking a driver’s education course you can save money on your policy.

- Auto Safety Features – You can save money on your 21st Century car insurance if there are safety features in your vehicle such as airbags and anti-lock brakes.

While not really a discount on your insurance policy with the 21st Century insurance Good Friend program you can get a prepaid American Express gift card worth $50 if you refer someone to 21st Century insurance.

21st Century Auto Insurance Pros and Cons

Pros

- Offers good auto insurance coverage at affordable prices

- You can take care of most things online

- Solid reputation being a part of the reputable Farmers Insurance Group

- Several discounts available

- 24/7 customer service

- In the insurance business since 1958

- Nice 21st Century mobile application

- Good options for high-risk drivers

- Positive 21st Century auto group reviews

- Easy to make 21st Century insurance claims

Cons

- Only available in California

- Only auto insurance available

- No agents with everything done online or over the phone

FAQ

Does 21st century insurance offer student discounts?

Yes. 21st Century offers student discounts for drivers that are 25 years and under and maintain a B average.

Who owns 21st century auto insurance?

21st Century car insurance is a small subsidiary of Farmers Insurance, which is one of the biggest insurance carriers in America offering insurance products in all 50 states.

Is 21st century insurance a reliable company?

21st Century is a very reliable insurance company that was established in 1958 and has a very good reputation. They are a part of the Farmers Insurance Group and are one of the biggest insurance carriers in America. You can also see they are reliable by looking online can checking the many positive 21st Century auto group reviews.

What are 21st century insurance working hours?

21st Century insurance customer service representatives are available from 7am to 7am PDT Monday-Friday and from 7am to 6am PDT Saturday. They also have an Interactive Voice Response system (IVR) and website available 24/7.

How do you contact 21st century insurance?

You can contact 21st Century insurance through a 21st Century phone number, fax, and by snail mail. All the physical addresses for things such as claims, payments, and general inquiries can be seen here. The customer service email address is [email protected] and for claims inquiries the address is [email protected]. The phone numbers are:

- Customer Service – 1-877-401-8181

- Start a Quote – 1-877-310-5687

- 21st Century insurance claims – 1-888-244-6163

Does 21st century insurance have an app?

Yes. 21st Century car insurance has a mobile application that you can get, free of charge, from the Apple Store or Google Play. In the app and on the website you can use the 21st Century insurance login to manage your policy and make payments on your premiums.

What is the 21st Roadside Assistance Program?

21st Century car insurance offers free roadside assistance up to $75. You can choose to increase the amount if you wish and you will be charged a fee depend on the limit you want.

What are my payment options with 21st Century Insurance?

The payment options available at 21st Century auto insurance are:

- ACH payments – bank accounts

- The credit cards of Visa, Mastercard, and Discover

- Money orders

- Visa or Mastercard debit cards

You can make a payment online by using the 21st Century insurance login, over the phone by calling the 21st century insurance phone number at 1-877-310-5687, or through the mobile application.

Summary

21st Century car insurance was established in 1958 and they offer solid auto insurance at good prices. You can save a lot of money on your premiums with all the discounts they offer. They are one of the better carriers for high-risk drivers as well as people that do not want to use an agent, as everything can be done over the phone or online. They are a subsidiary of the Farmers Insurance Group, which is one of the biggest and most reputable carriers in the United States. You can take care of everything online or over the phone and there is no need to deal with agents. Overall, 21st Century insurance is a good option for California drivers with all the solid coverage they offer.