AARP Nylife Login

Members of AARP have access to exclusive insurance programs via partnerships with various companies. Health insurance policies (both individual and supplemental) are available to residents in states across the country. Access your policy online by enrolling for online access. Health claim processes vary according to plan provider and policy type. Use the how-to guides on this page to learn how to sign in to AARP online, register a new account, and report a claim.

How to Log In

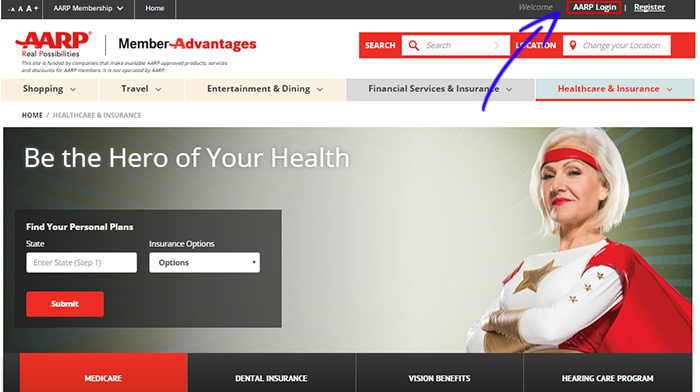

Step 1 – Go to the main health page either by right-clicking the login button at the top of this page (and hitting ‘load in new window/tab’), or by entering http://advantages.aarp.org/en/healthcare-insurance.html into your browser’s URL bar.

Step 2 – Click the ‘Login’ link in the upper-right corner of the page. The login form will generate in a new window.

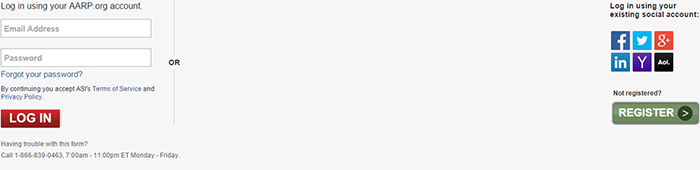

Step 3 – Enter your email address and password into the input fields and click the login button.

Forgot Password – In the login form, click the ‘Forgot your password?’ link. Enter your account’s email address. A password reset link will be sent to your inbox.

Enroll in Online Access

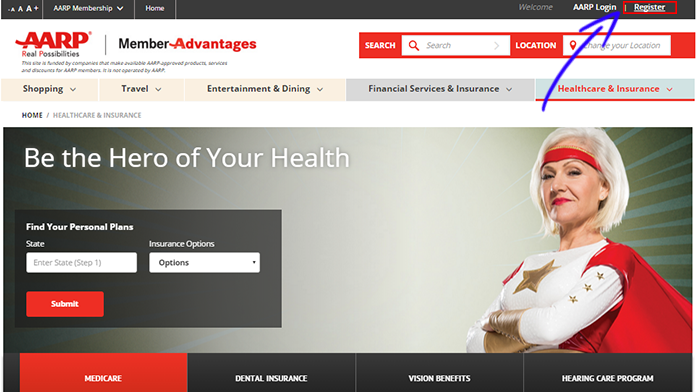

Step 1 – On the insurance page, click the ‘Register’ link in the top-right corner of the page. The registration form will load in a new window.

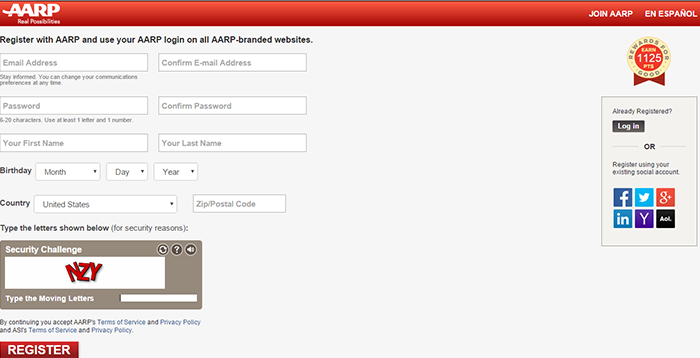

Step 2 – Enter your email address, create a password, enter your first/last names, date of birth, country, and ZIP code.

Step 3 – Click the ‘Register’ link at the bottom of the form to finish the enrollment process.

Make a Claim

Step 1 – Go to the health insurance company’s website (e.g. UnitedHealthcare) and follow their specific health insurance claims process. To contact AARP customer service and receive claim filing instructions/updates on the status of your claim, call 1-888-687-2277.

AARP Insurance Review

The American Association of Retired Persons (AARP) is an organization with a long tradition,founded in 1958. There are 38 million AARP members and they offer senior citizens many thingsincluding a wide array of insurance products. Not only do they offer dining, entertainment, andvarious travel discounts but, they are also associated with The Hartford, which has been in theinsurance business for over two centuries and is a very respected provider in America. The options that are available to members vary from state to state. The benefits are available topeople that are at least 50 years old. However, there are other products available to olderpeople as well such as Medicare plans for those that are at least 65 years old.

Pros and Cons of AARP Auto Insurance

Pros

- Wide range of insurance products

- Respected brand name

- Other perks for being member such as discounts on dining, entertainment, and travel

- Discounts for certain products and services

- Discounts on home, auto and renter’s insurance

- Low annual cost of membership

Cons

- Insurance policies can be more expensive for other providers

- Have to be at least 50 years old to be a member

- There have been member complaints about receiving a lot of junk mail

AARP Insurance Features

- Auto Insurance

- There is life insurance available through New York Life for AARP members.

- Homeowners Insurance

- Renters Insurance

- Umbrella Insurance

- Condo Insurance

- Flood Insurance

- Business Insurance

- Classic Car Insurance

- RV insurance

- Motorcycle insurance

- Boat insurance

- Golf cart insurance

- Snowmobile insurance

- Short term care insurance

- Dental insurance

In terms of Umbrella Insurance, it covers your liability over and above your auto as well as homeowner’s insurance. You can save a lot of money if you have auto and homeowner’s insurance through AARP.

AARP Hartford auto insurance login

You can login or create an account through the Hartford insurance webpage for AARP members. On that page, there are links for auto insurance as well as home and business insurance.

Full AARP coverage insurance

AARP offers full auto insurance coverage combining liability, collision, and comprehensive insurance along with other types of coverage that you might want.

AARP Hartford auto insurance pay bill

For AARP Hartford auto insurance you can pay bills online and by mail. You can also use themobile application to pay your insurance bills as well.

AARP auto insurance quote

It is very simple to receive an insurance quote from the AARP Auto Insurance Program from TheHartford. You can request a quote online, by calling directly, and by meeting with a local insurance agent.

AARP car insurance login

On The Hartford insurance webpage, which you can visit HERE, for AARP members you can login to your account. Once there you can review your policy, file a claim, make a payment, and see all of the auto insurance options available to you.

NYLAARP manage my payments / NYLAARP manage my account

There is a special AARP Life Insurance Program from New York Life website where you can manage your payments. Not only can you make payments through the site but you can also manage your account. You can do such things as:

- Update your personal information

- Access important forms

- Manage beneficiaries

How do I login to AARP?

You can login and create an account on the main AARP website at www.aarp.rog. While there is insurance information on the site there are more specific sites depending on the insurance you have such as the AARP life insurance program New York Life and AARP Hartford insurance site for AARP members; the link is above.

NYLAARP phone number

The AARP life insurance program New York Life phone number is 1-800-592-2936 and theworking hours are:

- Monday – Friday: 8 a.m. to 6 p.m. (EST)

- Saturday: 9 a.m. to 5 p.m. (EST)

- Sunday – Not available

FAQ

What Does AARP Car Insurance Include?

AARP Auto Insurance offers standard car coverage products such as Collision, Personal InjuryProtection. Uninsured Motorist, and Liability. Other optional auto insurance features such asRental Reimbursement, Roadside Assistance, Accident Forgiveness, and Auto Glass Repair.When it comes to auto insurance, AARP members can also get discounts on policies and some of those include Defensive Driver, Driver Training, Anti-Theft, and Multi-Policy.

How Much Does AARP Auto insurance Cost?

The costs of AARP auto insurance will differ depending on insurance options you have in yourpolicy, your driving history, and what state you live in. There are other things that also factorinto your cost of AARP auto insurance such as the discounts you can receive for things likedriver’s training, anti-theft devices installed on your vehicle, and if you have more than oneAARP policy.

What Do I Do if I Forget My AARP Password?

- If you forget your AARP password you can reset it by following these simple steps:

- Input your e-mail address that was used when you set up AARP account.

- Answer the security questions. ·Click on the Reset button.

- You will receive an e-mail with the subject of “Reset Your AARP.org Password.”

- Open the e-mail above and click on the button of Reset Your Password.

- Enter your new password created two times and then click the button Create.

- You will then be directed to the AARP website login page where you can log in to your new account using your new password.

- If there are any further issues you can call AARP (888-687-2277) for further assistance.

How Can I Make a Car Insurance Claim With AARP?

After an accident you can get in touch with The Hartford by phone 877-805-9918 or online. Youcan also file a claim and track it through The Hartford mobile application. Your claim can beprocessed 24/7 and right after representatives will help you resolve the issue. The mostcommon auto claims are:

- Reporting a claim on your AARP auto insurance policy

- Reporting a glass-only claim

- Reporting a claim on someone else’s auto insurance policy

When you talk to a representative you can describe the accident in question. You may be asked to submit photos, so right after the accident, if possible, it is a good idea to take photos of vehicles involved. Once the claim is processed you can check the status of it by tracking it online or by speaking directly to your claims representative.

Does AARP Auto Insurance Have an App?

Yes. There is an AARP auto insurance app through The Hartford and the page for the applicationcan be visited HERE. Through the app you can do such things as receive roadside assistancereceive a digital ID card, and report a claim, and much more. The app is available for iOS andAndroid users, with links for each on the page, and it is free to download.

How Do I Log In to AARP?

You can login to your AARP account through the AARP webpage. For other insurance options you can also login to other pages such as The Hartford for AARP members and NYLAARP. service account.

How Do I Pay My AARP Insurance Online?

You can pay your AARP insurance online but it will depend on the type of insurance you have. To pay for AARP life insurance you can log in to the NYLAARP site and for auto and homeowners insurance you can log in to The Hartford site for AARP members.

How Do I Contact AARP Life Insurance?

You can contact AARP life insurance online or over the phone. NYLAARP deals with the life insurance policies for AARP and their phone number is 1-800-592-2936. If you want to contact them online you can visit their website HERE.

How Can I Learn About All of the Products that AARP offers?

You can learn about all the products offered on the main AARP website. There is a Memberships & Benefits link that has a ton of information, in links, for categories like:

- Health & Wellness

- Travel

- Finances

- Insurance

- Gas & Auto Services

- Restaurants

- Shopping & Groceries

- Work & Jobs

- Technology & Wireless

- Family Caregiving

- Home & Real Estate

- Entertainment

- Community

- Advocacy

- Magazines & Resources

How are The Hartford for AARP Members Auto Insurance Reviews?

The Hartford has had solid reviews over the years. At the time of writing the provider has a JDPower rating of 4/5 as well as a customer satisfaction rating of 879 of 1,000. Like every insurance company, there are some bad ones out there but there are not many for the Hartford.

Conclusion

AARP is a very known and reputable organization and one thing they offer is a wide assortment of different types of insurance options. They are partnered with some great providers such as

The Hartford and New York Life to offer members some of the best insurance possible covering many needs.

It is always beneficial to get solid insurance coverage and that is just one of the things being an AARP member can offer. There are many other benefits to being an AARP member, but their insurance products are top-notch and as a respected organization they are transparent in exactly what they can offer.