AIG life insurance customers (both AIG Direct and American General Life) can access their policies online via ‘eService.’ Once logged in to eService, policyholders can update billing details, request changes to their policies, view claim statuses, and more. Current customers can learn how to access eService by reading the quick-guides below. If you have purchased a policy, but have not yet created an online account, learn how to register one in the ‘Enroll’ guide. A general overview of the death claims process can be viewed at the bottom of the page.

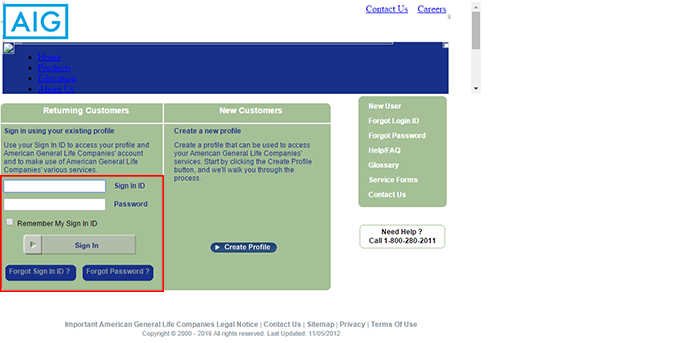

How to Log In

AIG login

Step 1 – Click the login button at the top of this page to go directly to the eService sign-in page (note: load the page in a new tab/window so you can follow along with this guide).

Step 2 – Enter your sign-in ID and password. Click ‘Sign In’ to access your account.

Forgot Password – Press the ‘Forgot Password?’ button below the sign-in input fields. Enter your sign-in ID and hit ‘Submit.’ Follow the on-screen instructions to continue and complete the password reset process.

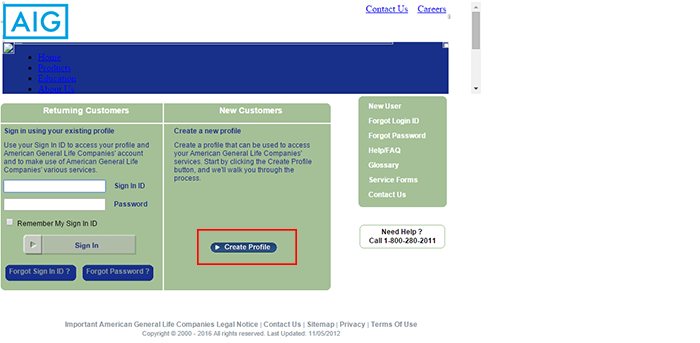

Enroll in Online Access

Step 1 – On the login page, click the ‘Create New Profile’ button as outlined in the screenshot below.

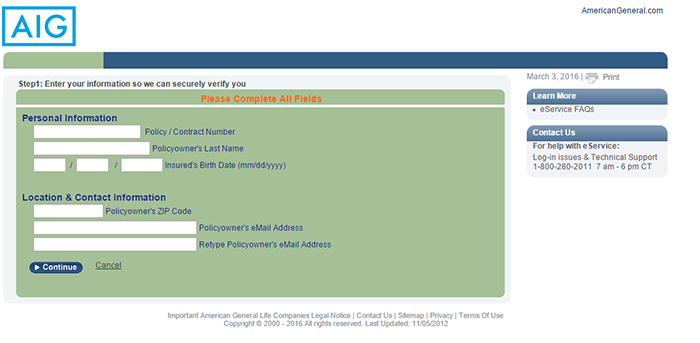

Step 2 – Enter the following information into the form:

- Policy number

- Last name

- Date of birth

- ZIP code

- Email address

Press the continue button at the bottom of the form to move to the next step.

Step 3 – Create your username, password, and security credentials.

Make a Claim

Go to the claims page and review what documents/information you will need before starting the claims process.

Step 1 – Call the customer service center at 1-800-521-2773. After submitting your claimant statement (and other required documents) to the customer service department, your claim will be processed.

AIG Life Insurance Review

AIG (American International Group, Inc) is one of the largest insurance carriers in the world and they offer their insurance products in 80 countries. The company serves millions of people around the world and offers life insurance at an affordable price. AIG insurance not only offers life insurance but also:

- General insurance

- Health insurance

- Vehicle insurance

- Travel insurance

- Home insurance

- Mortgage loans

- Investment management

- Mutual fund

In terms of life insurance AIG offers:

- Term Life Insurance

- Universal Life Insurance

- Guaranteed Issue Whole Life Insurance

The reputable company is one that is financially stable with $586.48 billion in total assets in 2020. On the AIG insurance website there is the AIG login where you can manage your policy/policies as well as make payments on your premiums.

Types of Coverage AIG Life Insurance Offers

There are 10 AIG insurance plans from accidental death plans with acceptance that is guaranteed to policies that are permanent that offer millions of dollars in coverage. Here are the plans offered:

Accidental Death Insurance

AIG life insurance offers accidental death for both you as well as your family giving you solid coverage if there is an accident and you pass away or are injured in a serious manner. You can get up to a half a million dollars in coverage and people between 18-80 years of age can get this insurance and you do not have to take a medical examination and you cannot be denied coverage.

Guaranteed Issue Whole Life

This coverage has guaranteed acceptance if you fall between 50 and 80 years of age. There is no need to take a medical examination and you will not be asked any questions in terms of your health. The range of the coverage starts at $5,000 and goes to $25,000 and in your lifetime, you can rest assured with protection that is permanent.

AIG Life Insurance Terms

This is an affordable coverage option and you can purchase coverage for a set period of time (10 to 35 years). If you have this coverage and pass away the death benefits will go to your beneficiaries. When this AIG life insurance term passes the expiration date you will not be covered any longer. You have limits all the way to $10 million with 35 years the max term.

Quality of Life Plans

There are benefits that are accelerated in the Quality of Life (QoL) plans and you may be able to get early death benefits. The QoL plans offered are:

- QoL Flex Term

- QoL Max Accumulator+

- QoL Value+ Protector

- QoL Guarantee Plus GUL II

Universal Life Insurance

In the AIG insurance policies for universal life you have a death benefit that is flexible and it is similar to a long term savings account. The AIG life insurance universal life policies are:

- Guaranteed Universal Life – In this coverage you get to pick the coverage period that you have as well as the makeup of the premium. There is a death benefit that is guaranteed and that is combined with cash value earnings.

- Index Universal Life – In this insurance option there is a benefit of death but you also have the opportunity to build up cash value. The cash value you accumulate with this policy is how the stock market index is performing.

- Platinum Choice VUL 2 – This is a type of variable insurance policy that has premiums that are flexible and there are benefits of death. The cash value that is surrendered will be guaranteed with the value coming from how the market is performing in the investments that you have made. A medical examination may not have to be done but that will depend on how old you are and the amount of coverage you want to have.

AIG life insurance offers riders, which are add-ons to your policy, which you will pay more for. Here are the available riders:

- Accidental Death Benefit – If you add this rider, your family receives an additional benefit if you pass away as the result of an accident that is one that is covered. It can be for a maximum of $250,000 or the value of the policy and will depend on which one is less.

- Child Rider – You can add your children to your AIG insurance policy. If something happens to your child or children, you are the one that would receive the benefit of death. You can add children from when they are only 15 days old until they turn 19.

- Terminal Illness – In this rider you can receive an acceleration of one time only up to half of your benefits of death. The maximum benefit is $250,000 and for this rider to take effect a terminal diagnosis has to be covered.

- Waiver of Premium – If it happens that you are disabled on a permanent basis this rider will make sure that you will have continued coverage. However, there are no more payouts for premiums. Eligibility is for people that have to have a value of an AIG policy of at least $100,000.

AIG Life Insurance Prices

AIG insurance offers life insurance products at a competitive price and on the website, it states you can get solid coverage for as little as $14 a month. However, some of the insurance products offered are higher than other insurance carriers. The factors that will determine the price of the AIG life insurance you get are:

- Type of coverage you want

- Your age

- Health status

- Gender

- If you are a smoker

- Health history of your family

- Your lifestyle

- Your driving record

- If you have a criminal record

- Your travel plans

If you want pricing information you can get it on the AIG insurance website through the AIG life insurance login in the AIG e-service portal and you can also call them at 1 (800) 445-7862.

AIG Life Insurance Discounts

Unlike the other insurance products offered by AIG insurance there are no life insurance discounts. However, you can save money on the policy that you get by buying more coverage, for a better long-term deal, and if you are not a smoker and are in good health. The best way to see if you can get discounted AIG life insurance is to call them or use the AIG insurance login.

AIG Life Insurance Pros and Cons

Pros

- One of the biggest insurance carriers in the world

- Many coverage plan options

- Competitive prices

- Good riders available

- Financially stable carrier

- Other insurance products offered

- Solid customer service

- Good AIG direct life insurance reviews

- High coverage amounts

Cons

- Cannot get a quote online

- No discounts available for AIG life insurance

- Some AIG life insurance products can be more expensive than through other carriers

- Worse than average complaint ratios

FAQ

How to use AIG broker login?

To use the broker login at AIG life insurance you will first have to fill out the form here and then the company will get back to you. Then you can use the broker portal. There is also a broker services phone number at 1 (877) TO-SERVE.

How do I use AIG payment?

You can use AIG payment to make payments to your premiums online, over the phone, and by sending checks by snail mail. You can make a one-time payment and set up recurring payments by using the AIG life insurance login. You can make an AIG payment by phone by calling 1-888-978-5371 if you have a billing address in the continental US. To send checks by snail mail you will see the addresses on this page.

How to reset my AIG eService password?

To reset your AIG e-service password you have to login to your account. Then you will click Forgot Password and enter your sign-in ID. You will then choose a preferred method for authenticating your identity and then click Continue. Answer the question and then click OK. You will be sent a 72-hour temporary password and you can sign in with that within the 72 hours and then you can reset your permanent password and confirm it.

What are AIG life insurance working hours?

The AIG life insurance working hours differ considering there are several offices in the United States as well as the world over.

How do I contact AIG customer service?

You can contact AIG insurance customer service online, by phone, by fax, and by snail mail. On this page you will find all of the contact information.

What does AIG stand for?

AIG stands for American International Group, Inc.

How to make a claim with AIG life insurance?

You can make a claim on this page and fill in your policy number. You can also call 1 (800) 445-7862.

Summary

AIG is one of the biggest insurance carriers in the world and offers a wide array of insurance coverage options including 10 life insurance plans. The company is a financially stable one that offers life insurance policies at a competitive price. There are solid AIG direct life insurance reviews and it is easy to get a quote and make a claim. The customer service support team is a good one, which will work with you to find the best AIG life insurance coverage possible for your specific situation.

Related Life Insurance Articles

- What is Life Insurance?

- Whole Life Insurance

- Term vs Whole Life Insurance

- LIRP: A Life Insurance Tax-Free Retirement Plan

- Colonial Penn Life Insurance 2023

- Life Insurance With Pre existing Conditions

- The importance of assigning a Beneficiary

- The Types of Life Insurance – Explained

Life Insurance Tips

- Is Life insurance a good career path?

- How to Start Selling Life Insurance

- How To Use Life Insurance While Alive