ASI home insurance policyholders can access policy details, make payments, contact agents and file claims online. To learn more about how to sign up, sign in, make payments and file claims, follow the instructions given below.

ASI Insurance login

How to Log In

Step 1 – All ASI policies are managed online via my.asiplocy.com. This is the company’s policy management website. Go to the homepage and click on the ‘Manage My Policy’ link as shown below. You will be redirected to the login page.

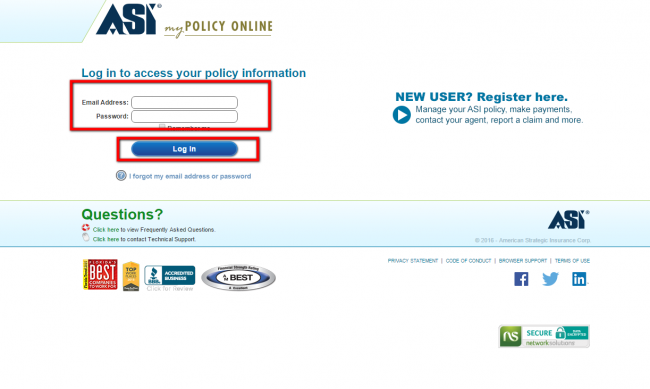

Step 2 – Enter your login details (your email address and password) and click ‘Login’ to access your account.

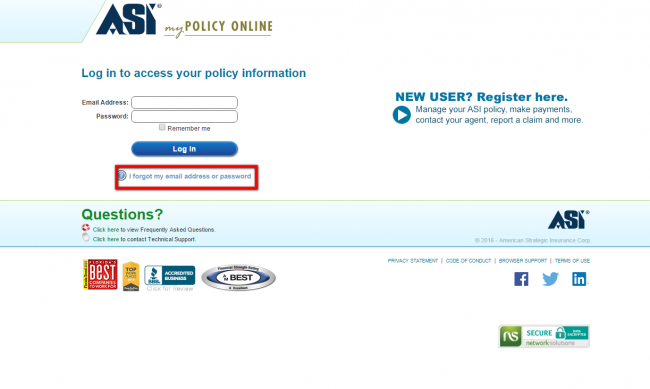

Forgot email address or password – you can recover your email address and reset your password by clicking on the link below the login form as shown below.

Enroll in Online Access

Step 1 – Go to the homepage and click on the Manage My Policy link as shown below.

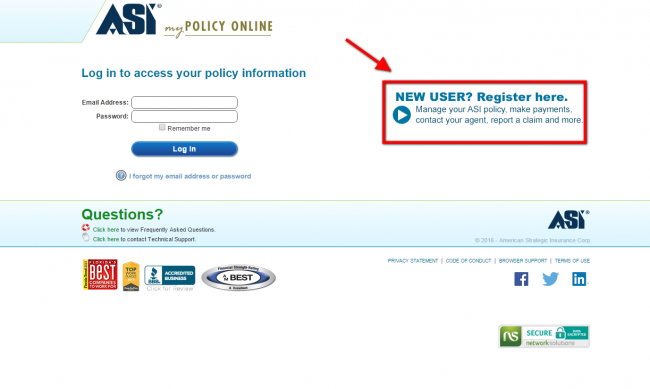

Step 2 – You will be redirected to the login page. Click on ‘Register Here’ as shown below.

Step 3 – Create a new profile by entering your name and email address. You will also be required to create a password. Under ‘add a policy’, enter your policy number, date of birth and last name. Click on the ‘Save Profile’ button to complete the process.

Make a Claim

You can make a claim by calling 866-ASI-LOSS, sending an email to [email protected] or sending a fax to 866-249-9787. You can also file a claim online by following the instructions below.

Step 1 – On the homepage, click on the Report a Claim link as shown below.

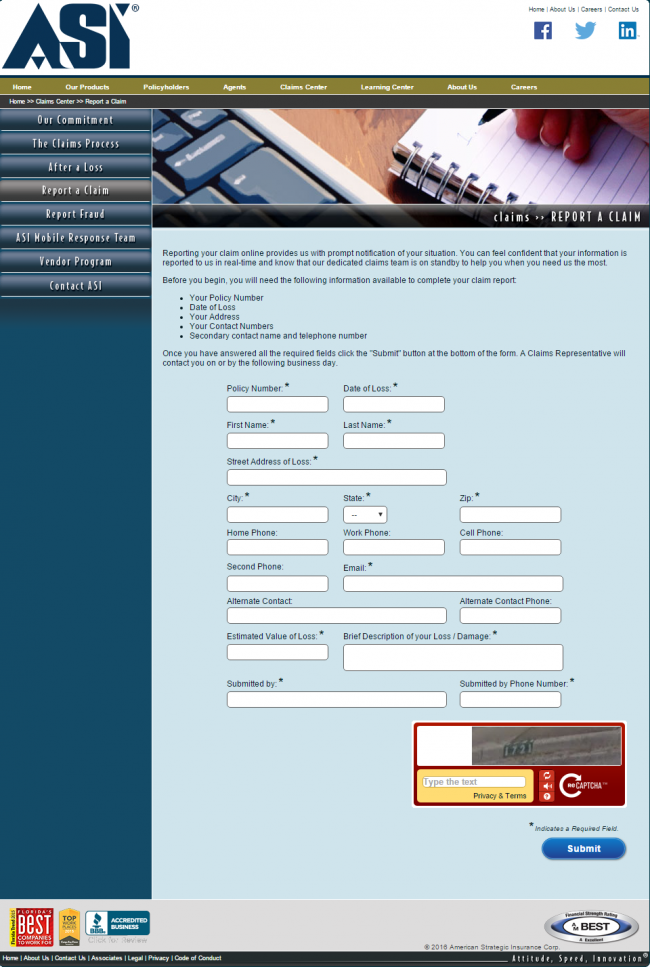

Step 2 – You will be redirected to the claims form. Enter your policy number, date of loss, address and contact details. Click Submit at the bottom of the form. You will be contacted by a claims representative on the following business day.

ASI Home Insurance Review

ASI (American Strategic Insurance) is a homeowners insurance carrier that was established in 1997 and they are part of the Progressive Group of Insurance Companies. They offer good coverage options at competitive prices and one of the nice things about the company is the number of discounts they offer. Being part of the Progressive family, you can be sure the company is financially stable and they are one of the 15 biggest residential property insurance carriers in the United States.

ASI insurance offers their policies in 27 states and it functions as a group under one umbrella with several companies, which are:

- America Strategic Insurance Corporation

- ASI Lloyds

- ASI Assurance Corporation

- ASI Preferred Insurance Corporation

- ASI Select Insurance Corporation

- American Capital Assurance Corporation

- ASI Home Insurance Corporation

On the ASI webpage you can quickly and easily receive a quote and through the ASI insurance login you can manage your policy/policies and make payments.

Types of Coverage ASI Home Insurance Offers

The types of insurance coverage that ASI offers are:

- Homeowners

- Condo

- Renters

- Umbrella

- Flood

ASI Home Insurance

Things such as storm and fire damage and theft are covered in ASI homeowners insurance and you can tailor the policy to get exactly what you need. This type of coverage helps with the costs of:

- Replacing the value of your home and other structures that are attached to it such as a garage or a shed.

- Your personal property and any of your personal belongings.

- Expenses for living such as room and board, and even laundry expenses, if your home is under repair and you need to stay somewhere else.

- Coverage for personal liability and payments for medical expenses if a guest in your house was injured or they were injured while on your property.

You have the opportunity to have additional coverage such as rASIing limits on jewelry as well as on personal injury.

Condo

If you have lived in your condo for at least four months per year the condo policy you have through ASI insurance covers:

- Personal property in your condo.

- Walls on the inside of your condo, other fixtures, and other items that are attached on a permanent basis.

- Personal liability as well as payments for medical expenses.

Renters

A renter’s insurance policy through ASI can give you an inexpensive policy that offers coverage to both renters and tenants. You can get coverage for all personal items that are not covered by the policy that your landlord has. The renter’s policies are not all the same but some of the things covered include the costs of:

- Theft

- Vandalism

- Fire damage

- Smoke damage

- Damage from wind, lightning, and storms

- Water damage

An ASI insurance renter’s policy may also give you coverage for personal liability and payments for medical expenses.

Umbrella

An ASI umbrella insurance policy gives you more liability above and beyond your limits for your primary insurance. For example, if you have an ASI homeowner’s insurance policy for $250,000 it could turn into $1.25 million if you decide to buy an umbrella policy for $1 million. Usually, ASI offers.

- Coverage limits for $1 million and $2 million

- Coverage for personal injury for types of claims like libel and slander, the invasion of your privacy, and character defamation.

- Coverage for lawyer fees and other costs in the legal process.

Flood

Through a ASI homeowners insurance policy you can be covered up to $250,000 for the structure of your home and up to $100,000 for contents inside it.

ASI Home Insurance Prices

ASI home insurance offers affordable prices for their home insurance policies. The price that you pay will differ on what type of coverage that you want and will also depend on such things as:

- What state you live in

- The area where you live

- If you live in a gated community

- The age of your home or dwelling

- The condition of your home or dwelling

- If you have safety features installed in your home or dwelling, such as fire alarms, theft alarms, and fire extinguishers.

Through the ASI insurance login on the website you can get pricing information and you can also get it by calling the general enquiry number of (866) 274-8765.

ASI Home Insurance Discounts

You can get quite a few discounts through ASI insurance and you can really save if you bundle. You have to check if the state has the bundle insurance options and also check with ASI for partners that allow bundling with their homeowner’s insurance policies and just a couple of the partners that are recommended by ASI insurance are Progressive Home Advantage and USAA.

Other ASI insurance discounts available are:

- Non-smoker Discount – You can save if all of the residents of the home are not smokers.

- Protective Device Discount – Save if you have safety devices installed in your home such as fire and theft alarms and smoke detectors.

- New House – You can get a discount on your ASI homeowner’s insurance policy if you recently bought a new house.

- New Construction – Save money if bought a house that was recently built.

- Secured Community/Building Discount – You can get a discount if the home that you own is located in a gated community.

- Electronic Policy – If you choose to get all of the documents for your insurance policy by email rather than by paper.

- Window/Opening Protection – If you have bought windows that are impact-resistant on your home.

- Pay in Full – You can get a discount if you pay for your yearly policy in one payment.

- Umbrella Discount – If you have an umbrella policy through ASI home insurance you can save a significant amount of money.

ASI Home Insurance Pros and Cons

Pros

- Solid coverage options

- Many discounts available

- Manage your policy online through your ASI insurance login

- Part of the reputable Progressive Insurance Group

- Good ASI insurance reviews

- Nice customer service

Cons

- Not available in all states

- Not the most established carrier

- Can have higher rates for premiums

FAQ

Is ASI a good insurance company?

ASI is a good insurance company that offers solid insurance coverage at affordable prices. They are part of the reputable Progressive Insurance Group and they are a financially stable carrier that has received very solid ASI insurance reviews.

What does ASI homeowner insurance include?

ASI homeowner’s insurance offers solid coverage options for your home for both damage to it as well as coverage for medical expenses if someone is injured on your property. They not only offer home insurance but to other things on your property such as a shed or garage and they have coverage options if you need to live somewhere else while your damaged home is being repaired.

How to find my ASI policy?

You can find your ASI policy by going to the website and using your ASI home insurance login where you can manage your policy as well as make payments and upgrades.

Is ASI progressive the same as Progressive?

ASI insurance is not the same as Progressive but since joining their group they do offer more things for their customers. Basically, the customers are the ones that have benefitted from the partnership, as ASI customers are getting all the current benefits while getting more from the reputable Progressive name.

What is the ASI HomeShield package?

There is the ASI HomeShield package that offers dwelling replacement and additional coverage and personal property replacement as well. There is also the

HomeShield Plus package that has everything the original package has and comes with coverage limits that are higher.

How to file a claim with ASI insurance?

You can report a claim through ASI insurance both over the phone and online. You can make a claim online through the ASI home insurance website and you can also call the company directly at 1-866-274-5677. When you make a claim you will have to give the information of:

- Your ASI Policy Number

- The date of loss

- Your current address

- Your contact number/numbers

Where are ASI insurance offices located?

The headquarters for ASI insurance are located in St. Petersburg, Florida.

What are ASI insurance working hours?

There are ASI insurance representatives available 24/7 for claims and quotes and the office hours for the main office in St. Petersburg, Florida are 8 am to 5 pm EST Monday through Friday.

Summary

ASI insurance is a solid carrier that offers home insurance policies and other coverage options such as renters, condo, umbrella, and flood insurance. It is easy to get a quote and report a claim through my ASI policy login on the website. They have been in business over 20 years and you know they are reputable since they are now part of the Progressive Insurance Group. There are great discounts available to customers and the policies can be had at affordable prices. You get the best of both worlds through ASI insurance and Progressive, which is one of the biggest names in the insurance game.