You can compare the auto/car insurance rates of more than 200 insurance carriers by using TheZebra.com. Available to residents in all 50 states, The Zebra is one of the largest comprehensive auto policy quote comparison websites on the internet. The service is 100% free, and does not collect sensitive data (i.e. your SSN or driver’s license number) from you, unlike the majority of insurance companies/quote comparison sites.

How to Get a Quote

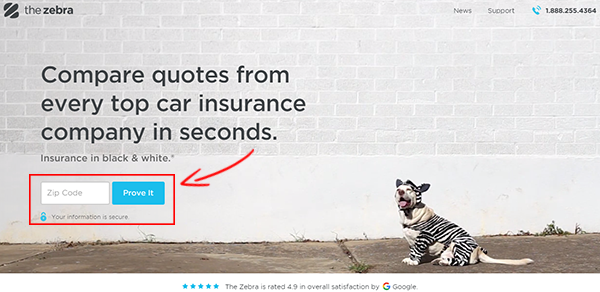

Step 1 – Beginning on the homepage, enter your ZIP code into the field outlined below, and then click the ‘Prove It’ button.

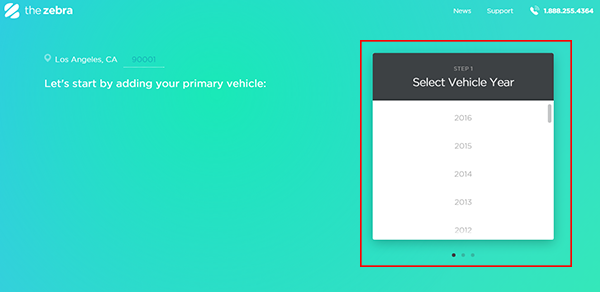

Step 2 – After entering your ZIP code, you will be prompted to select your vehicle year. Use the list on the right side of the page to choose the year of your car.

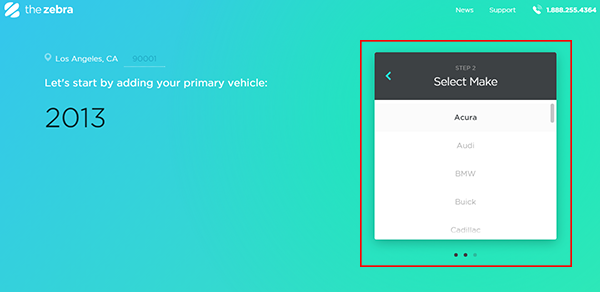

Step 3 – After selecting the year, choose the make of your vehicle.

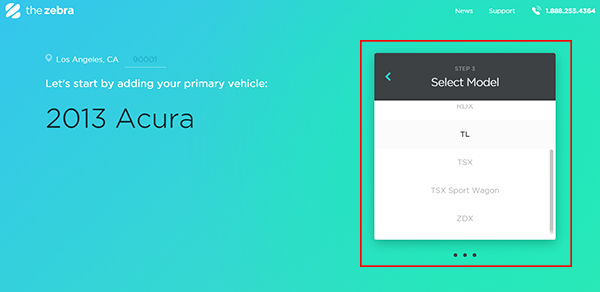

Step 4 – Select the specific model.

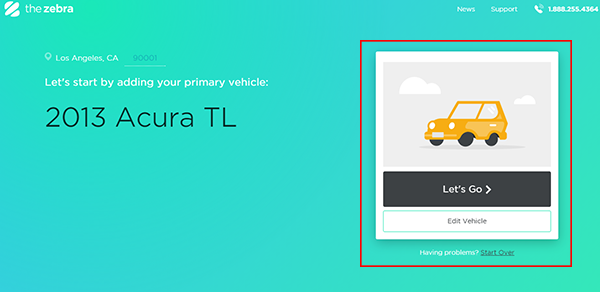

Step 5 – If you need to alter your car’s information, click the ‘Edit Vehicle’ button, otherwise press ‘Let’s Go’ to move on to the next step.

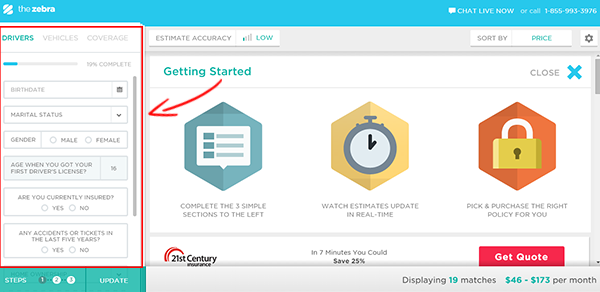

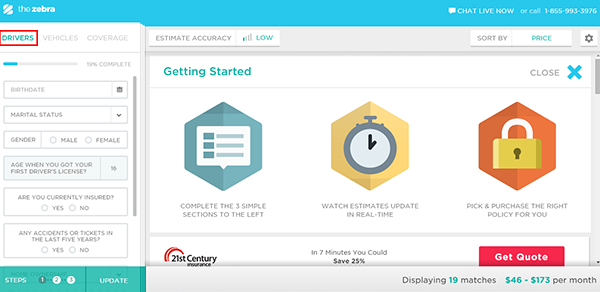

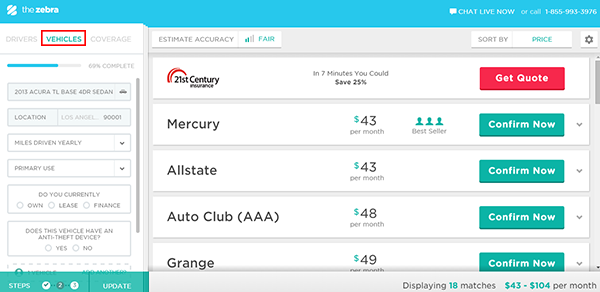

Step 6 – After entering your basic vehicle information, you will be redirected to the quote comparison page. In order to see accurate results, you must enter the required information (into the input fields located on the left side of the page, as outlined in the screenshot below).

Note: The accuracy of rates will increase as you enter more personal details.

Step 7 – Enter your date of birth, marital status, gender, whether you are currently insured, if you have had any tickets or violations within the past three years, and if you are a homeowner/renter (select other if none of the options apply). After entering these details, click the ‘2’ link on the bottom of the form OR the ‘Vehicles’ link at the top of the form.

Note: Available quotes will update as more information is entered.

Step 8 – Select how many miles are driven annually, the primary usage of the vehicle, whether it is owned or leased, and if there is an anti-theft device installed.

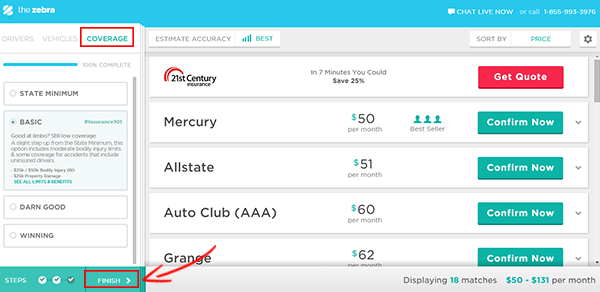

Step 9 – You can increase the amount of coverage you want on your policy by clicking the ‘Coverage’ tab at the top of the form. Options include (in order of lowest to highest) ‘State Minimum,’ ‘Basic,’ ‘Darn Good,’ and ‘Winning.’ Click the ‘Finish’ button at the bottom of the form to refresh the results.

Note: Press the ‘Sort By’ link near the top of the results to change the way your rate estimates are ranked. Click on a result to view more detailed information. If you are ready to purchase a policy, click ‘Confirm Now.’ A licensed agent will contact you with more information regarding the plan you selected.