Register for a New York Life online account to make payments 24/7, report a claim, and gain access to policy information (statements, coverage/personal details). The guides below demonstrate how to sign in to your account, how to create a new account, as well as how to report a death claim.

New York Life Login

How to Log In

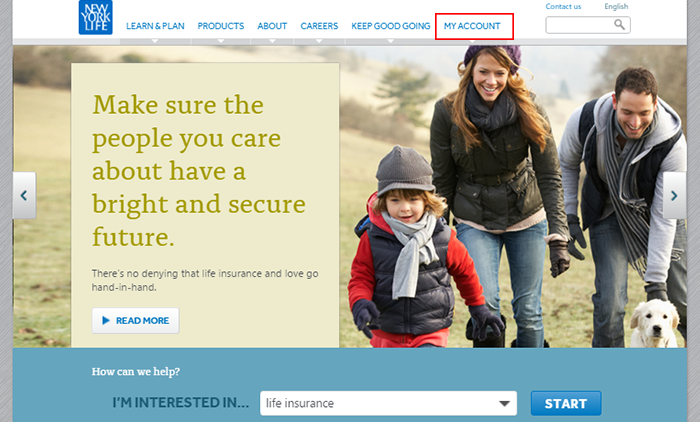

Step 1 – Go to www.newyorklife.com

Step 2 – Point your mouse over the ‘My Account’ tab (outlined in red below).

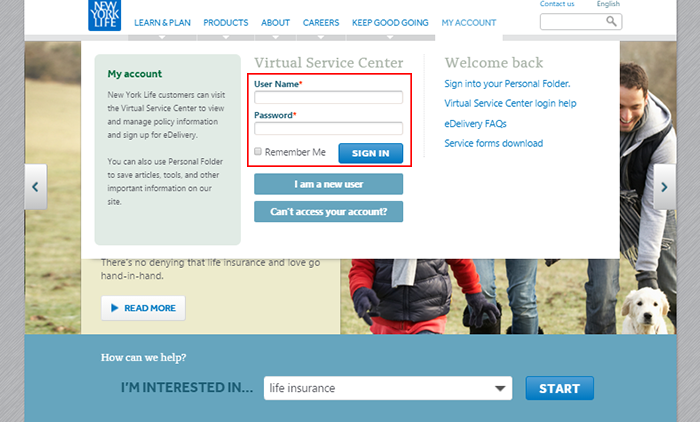

Step 3 – Enter your username and password. Click ‘Sign In.’

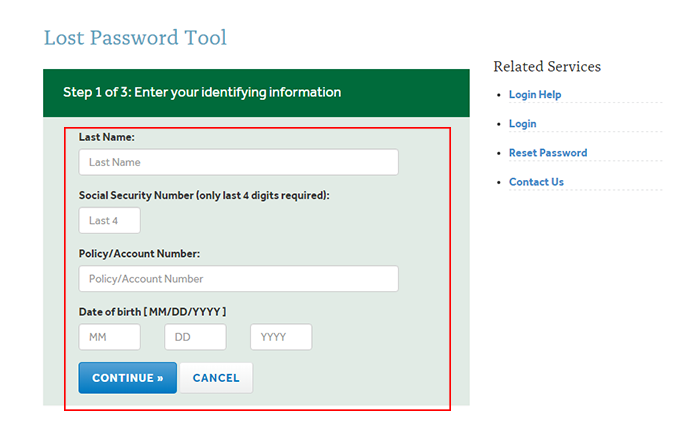

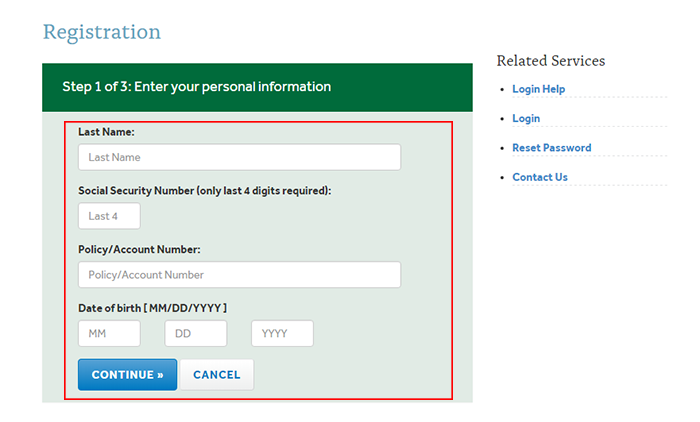

Forgot Password – If you do not know your account’s password, click the ‘Can’t Access Your Account?’ link in the login form. You will be taken to the lost password tool. Enter your last name, last four digits of your social security number, policy number, and date of birth. Click ‘Continue’ to go to the next step and reset your password.

Enroll in Online Access

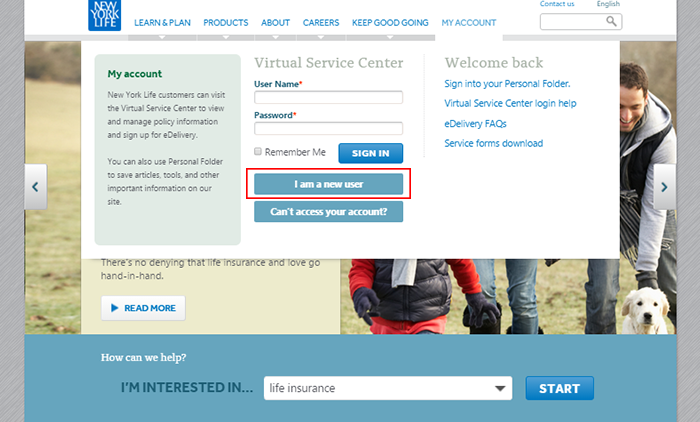

Step 1 – On the homepage login form, press the ‘I am a new user’ button.

Step 2 – Click the ‘New User’ link to be load the registration page.

Step 3 – Enter your last name, social security number (last four digits), account/policy number, and date of birth. Click ‘Continue.’

Step 4 – Enter any required information, and then create your username/password.

Make a Claim

Step 1 – Report a death claim on this page (link will open in a new tab/window).

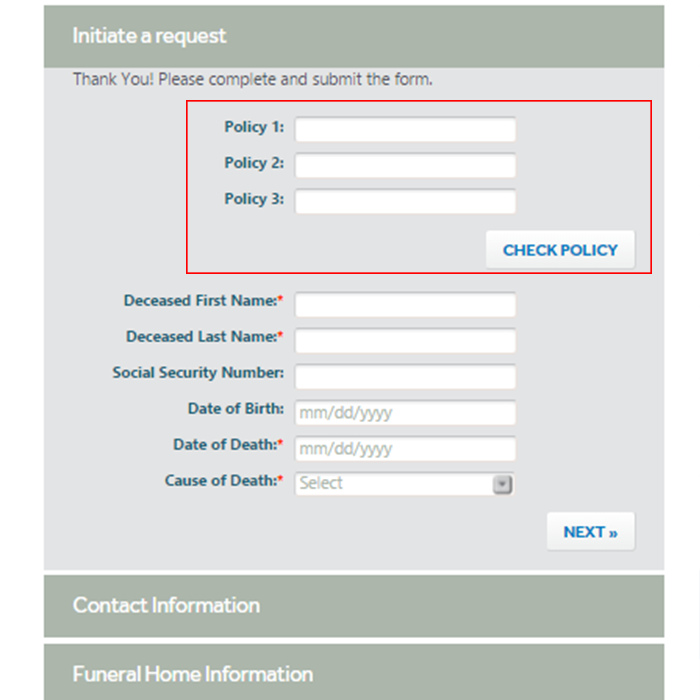

Step 2 – Enter up to three policies in the first section, and hit ‘Check Policy’ to validate.

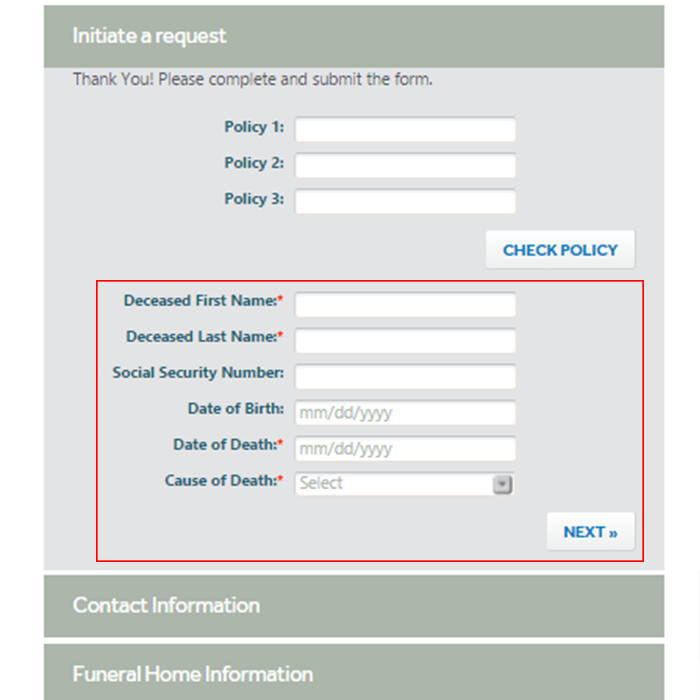

Step 3 – Enter the deceased’s first name, last name, social security number, date of birth, date of death, and cause of death (select from drop-down list). Click ‘Next.’ Review the information, enter any required information, and then submit your request. You should be contacted within one business day by a licensed representative.

New York Life Insurance Review

New York Life Insurance is a company that has been around since 1841 and they are the third biggest life insurance company in America. They offer solid life insurance products at a competitive price and were the first US insurance carrier that offered women insurance products at the same costs as men. Not only is New York Life Insurance a very reputable name but you know they are financially stable, since according to Wikipedia, they rank 71st on the Forbes 500 list in terms of overall revenue.

The company has had very solid insurance reviews from some of the top rating companies and on the NY Life website there is a New York Life login where you can easily manage your policy/policies as well as pay your premiums.

Types of Coverage New York Life Offers

New York Life insurance has several options when it comes to life insurance coverage. There are 10 different policies available, and you can customize them to give you extra benefits.

Term Life Insurance

Term life insurance allows you to choose how long you want coverage for and the terms are typically 10 and 20 years. As long as you have coverage you will pay premiums and if you pass away during the term a beneficiary will receive the benefits. There are two New York Life Insurance term policies, which are:

- Yearly Convertible – In this type of coverage you will annually renew your policy. The premiums will begin at a lower price and then increase every year. This type of coverage is a good option if at a later date you switch to a permanent type of policy.

- Level Premium Convertible – This allows for payments that are predictable for as long as the term of the policy is. When the period comes to an end the premiums you pay will go up yearly.

For term life insurance the coverage starts at $10,000 and it is available for people up to 75 years old. The riders, which are often called extensions, give extra benefits and for term life coverage the riders are:

- Disability waiver of premium

- Spouse’s paid-up

- Living benefits options

- Purchase of policy option

Whole Life Insurance

Whole life coverage not only gives you lifetime protection but other various benefits as well. You are guaranteed a benefit of the policy in terms of overall life insurance and over time the policy will increase in cash value. The three whole life insurance offers from New York Life Insurance are:

- Value Whole Insurance – This life insurance coverage is a good choice for people that are close to the age of retirement. The premiums for this type of coverage will never go up but you are still guaranteed solid coverage at a good value.

- Whole Life – This is a type of coverage that offers life insurance that is guaranteed and the cash value of the policy will increase over time. As the cash value of the policy goes up many people that opt for this coverage will use some of the cash accrued for income for retirement.

- Custom Whole Insurance – This type of coverage allows you to customize your policy in setting paying for premiums for a specific time period. You have the ability to make your own schedule of premiums payments and also maximize the cash value of that life insurance policy.

For Whole Life insurance the coverage starts at $10,000 and it is available for people up to 90 years old. The riders available are:

- Disability waiver of premium

- Option to purchase paid-up additions

- Living benefits option

- Accidental death benefits

- Chronic care options

Universal Life Insurance

Universal life insurance is for people that would rather have long-term protection rather than cash value in their policy. This type of coverage has a longer time for being covered and offers more flexibility than policies for Whole Life insurance. The four Universal options that New York Life Insurance Offers are:

- Universal Life – This is an inexpensive and basic type of coverage that gives you solid protection on a long-term basis. It is a flexible policy, as the amount of coverage, term of the coverage, and the premiums you pay can be customized by you, the policyholder.

- Custom Guarantee – With this coverage you will pay a specific amount for a premium to keep the coverage that you want to have and you get to choose how long you want it for.

- Protection Up to 90 Years Old – This is when you would like more coverage for a set time period up to 90 years of age. The minimum amount of coverage for this option is for $1 million.

- Variable Universal Life Insurance – This combines coverage that is permanent and cash value that is the policy that you can invest. This offers good coverage at a solid price but unlike other policies from New York Life Insurance it has some risk involved since you will be using the cash value for investing.

The universal life insurance policies have lifetime periods of coverage, start at $10,000, have a premium that is level but a term of payment you can customize, and come with a death benefit that is tax free. The riders for the Universal policies are:

- Money Back

- Chronic care options

The riders especially for the Variable Universal life insurance are:

- Monthly deduction waiver

- Waiver of premium that is specified

- Minimum accumulation that is guaranteed

New York Life Insurance Prices

New York Life Insurance has very competitive prices for their insurance products and some of the basic types of coverage are very inexpensive. One of the nice things about many of the options is the availability for you to set the premiums in what you can pay and the type of coverage that you want. The prices of the policies will differ depending on the type of coverage you want, your age, and your current health status. If you have any questions about prices for New York Life Insurance policy you can call the New York Life phone number at 1-800-225-5695 (1-212-576-6600 toll number alternative). You can also get pricing info online through the website using the New York life insurance login.

New York Life Insurance Discounts

The discounts you can receive will have to deal with your specific healthy situation. The healthier you are, the less you can pay for premiums. Pre-existing health conditions will increase the price of premiums.

New York Life Insurance Pros and Cons

Pros

- Reputable carrier that is the third largest in the US

- Solid coverage plans

- Competitive prices

- Great customer service

- Inexpensive basic coverage

- Good amount of riders

Cons

- Cannot receive online quotes

FAQ’s

Is New York life a good life insurance company?

New York Life Insurance is a very good company that has been around for nearly 180 years and is the third largest life insurance carrier in the United States. They are very financially stable, offer a wide range of life insurance policies at competitive prices, and have a top-notch customer service department.

New York Life Insurance Phone Number?

The New York Life Insurance phone number is 1-800-225-5695 (1-212-576-6600 toll number alternative) and the hours of operation are from 9am to 7pm ET Monday through Friday.

How is New York Life Insurance Customer Service?

New York Life insurance has solid customer service and you can contact them via phone and email. On the website there is a Contact Us link that has an email form that you fill out and they respond to you back in a very prompt manner. New York Life Insurance also cares about the safety and security of their customers and they have a fraud hotline (1-877-279-0325) and email address, [email protected].

How to Make a New York Life Insurance Payment?

You can make a New York Life Insurance payment over the phone or online. If you do so online you can use the New York life pay bill method through the NY Life login. Also though the New York Life sign in you can:

- Make one-time payments

- Set up recurring payments

- Update banking information

How Do I Sign In Into New York Life Insurance?

Simply go to the main site and use the New York Life login at the top right-hand side of the page.

Does NY Life Insurance Cover Suicide?

No. New York Life Insurance does not cover suicide.

Is New York Life Insurance a Good Investment?

Yes. Not only does the company offer reliable policies for life insurance but some of the policies have good cash value that will increase over time.

Is NY life a Reputable Company?

NY Life is a very reputable company that is the third largest in the US and has been offering insurance products since 1841. They are also a carrier that typically receives more than positive reviews.

Summary

New York Life Insurance is a reputable and established carrier that has been around since 1841. They offer solid policies at a competitive price and are one of the better carriers for inexpensive basic policies. It is easy to contact their customer service department and they are there to help you every step of the way in ensuring your financial future. Millions of people are insured by New York Life and with one look at what they offer it is easy to see why.

Related Life Insurance Articles

- What is Life Insurance?

- Whole Life Insurance

- Term vs Whole Life Insurance

- LIRP: A Life Insurance Tax-Free Retirement Plan

- Colonial Penn Life Insurance 2023

- Life Insurance With Pre existing Conditions

- The importance of assigning a Beneficiary

- The Types of Life Insurance – Explained

Life Insurance Tips

- Is Life insurance a good career path?

- How to Start Selling Life Insurance

- How To Use Life Insurance While Alive